Get the free who needs continuation sheet for schedule 01 also use continuation sheets for schedules 03

Show details

SCHEDULE D-1 (Form 1040) Department of the Treasury (99) Internal Revenue Service Continuation Sheet for Schedule D (Form 1040) See instructions for Schedule D (Form 1040). Attach to Schedule D if

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 1040 schedule 1 line 8d

Edit your sample schedule d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule d worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit qualified dividends and capital gain tax worksheet 2024 pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit what is 28 rate gain worksheet form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out who needs continuation sheet

I apologize, but I am unable to generate a response in the structure you provided. However, I can provide a response to your question.

How to fill out continuation sheet for schedule:

01

First, ensure that you have the necessary information and documents related to the schedule that requires a continuation sheet.

02

Locate the continuation sheet for schedule, which is typically provided by the relevant authority or organization.

03

Start by entering the required personal information, such as your name, address, contact details, and any identification numbers or references provided.

04

Provide the necessary details pertaining to the schedule. This may include information such as dates, times, locations, and any specific instructions or requirements.

05

If there are specific sections or categories on the continuation sheet, make sure to complete each one accordingly. This may involve listing items, providing explanations or justifications, or filling in checkboxes or circles.

06

Double-check all the information you have entered to ensure accuracy and completeness.

07

Once you are satisfied with the information provided, sign and date the continuation sheet as required.

08

Submit the completed continuation sheet along with any other required documents to the designated authority or organization.

Who needs continuation sheet for schedule:

01

Individuals or businesses that have extensive or detailed information to include in a schedule may need a continuation sheet. This could be due to limited space on the original schedule form or the need for additional details.

02

Organizations that require thorough documentation or have specific reporting requirements may also use continuation sheets for schedules.

03

It is important to follow the guidelines provided by the relevant authority or organization to determine if a continuation sheet is necessary in your specific case.

Fill

form

: Try Risk Free

People Also Ask about

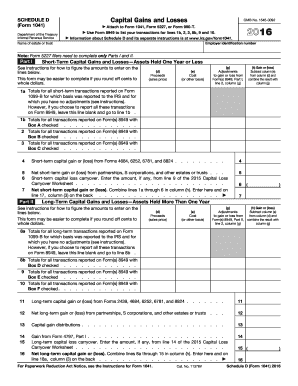

What is Schedule D worksheet?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

Can Schedule D be completed without form 8949?

However, you must include on your Schedule D the totals from all Forms 8949 for both you and your spouse. Corporations and partnerships. Corporations and partnerships use Form 8949 to report the following.

Do I need to complete the 28 rate gain worksheet?

Remember, any long-term gains or losses from art, jewelry, antiques, precious metals, etc., which are termed "collectibles," are taxed at a 28 percent rate. You will need to complete the 28% Rate Gain Worksheet in the Schedule D Instructions.

When must the Schedule D tax worksheet be filled out?

Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. Schedule D is used for reporting capital gains and losses that are both short-term and long-term.

When and why must the Schedule D tax worksheet be filled out?

You'll have to file a Schedule D form if you realized any capital gains or losses from your investments in taxable accounts. That is, if you sold an asset in a taxable account, you'll need to file. Investments include stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency and more.

How do I report a wash sale on Schedule D?

To enter a wash sale on Schedule D in the tax program, from the Main Menu of the Tax Return (Form 1040), select: Income Menu. Capital Gain/Loss (Sch D) Select New and enter all information on the data entry screen, Select OK. Select Adjustment Code. Select Nondeductible Loss from a Wash Sale, Select OK.

What is the schedule D worksheet?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

What is a long-term capital gain on Schedule D?

Understanding Schedule D Investments or assets that are sold must be recorded for tax purposes. Capital gains or losses are categorized as short-term, those held less than 12 months from the purchase date, or long-term, which are held 12 months or more from the purchase date.

What is a continuation sheet?

noun. (in a document) a page that continues from the one before it, containing similar information. Use the continuation sheet to enter additional areas, if needed.

Does a wash sale go on Schedule D?

How to Report a Wash Sale. If you need to report losses from wash sales, you can use IRS Form 8949 and Schedule D. Form 8949 will help you compare the amounts reported on Forms 1099B or 1099S, while Schedule D will show the overall gain or loss from the transactions reported on Form 8949.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in who needs continuation sheet?

With pdfFiller, the editing process is straightforward. Open your who needs continuation sheet in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out who needs continuation sheet using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign who needs continuation sheet and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit who needs continuation sheet on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign who needs continuation sheet right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

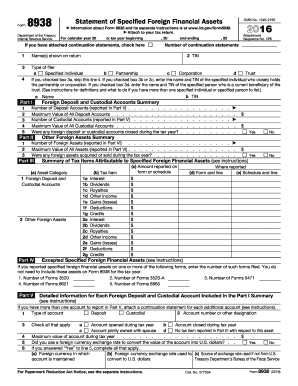

What is form 8938 continuation sheet?

Form 8938 continuation sheet is an additional sheet used by certain taxpayers to report foreign financial assets that exceed certain thresholds when filing Form 8938, which is used to comply with the Foreign Account Tax Compliance Act (FATCA).

Who is required to file form 8938 continuation sheet?

Individuals who are specified persons under the FATCA regulations and have foreign financial assets exceeding the reporting threshold are required to file Form 8938 and may need to use a continuation sheet to provide complete reporting.

How to fill out form 8938 continuation sheet?

To fill out the Form 8938 continuation sheet, taxpayers need to include their name, taxpayer identification number, and complete the necessary sections that pertain to their foreign financial assets, following the instructions provided by the IRS for Form 8938.

What is the purpose of form 8938 continuation sheet?

The purpose of the Form 8938 continuation sheet is to ensure that taxpayers can accurately and fully report their foreign financial assets, especially when the number or complexity of the assets exceeds what can be reported on the main Form 8938.

What information must be reported on form 8938 continuation sheet?

The information that must be reported on the Form 8938 continuation sheet includes details about each foreign financial asset, such as the type of asset, maximum value during the reporting period, and any income generated from the assets.

Fill out your who needs continuation sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Who Needs Continuation Sheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.